tesla tax credit 2021 georgia

Rebates are available through December 31 2021. Oregon offer a rebate of 2500 for purchase or lease of new or used tesla cars.

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Tesla Tax Credit 2021 Georgia.

. Nissan is expected to be the third manufacturer to hit the limit but. 1 Best answer. In other words if the law is passed buyers of the next 400000 Teslas sold will have access to the 7000 credit.

This story originally. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate. Sales of 2022 of Electric Vehicles continues go grow.

By Michelle Jones February 11 2021. A refundable tax credit is not a point of purchase rebate. The total amount of tax credit for a taxpayer or affiliated entity shall not exceed the lesser of taxpayers income tax liability or 25000000.

Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. The renewal of an EV tax credit for Tesla provides new opportunities for growth. Bmw Philippines Price List 2021 Spy Shoot Bmw I8 Bmw Bmw Car Models.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Income Tax Credit Policy Bulletins. Proposed reforms for the federal incentive program for electric vehicles would grant Tesla access to more tax credits on its cars.

This percentage is valid through 2022. Tesla tax credit 2021 georgia Monday February 28 2022 Edit. Place an 80000 price cap on eligible EVs.

The second document made further changes. Once EPD verifies all the requirements have been met EPD will sign the form and send it back to you. Battery pack bonus.

Create an additional 2500 credit for assembled in the US. Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

EV federal tax credit The. FAQ for General Business Credits. Colorado also has various incentives for select solar utilities.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. After that the credit phases out completely. Then from October 2019 to March 2020 the credit drops to 1875.

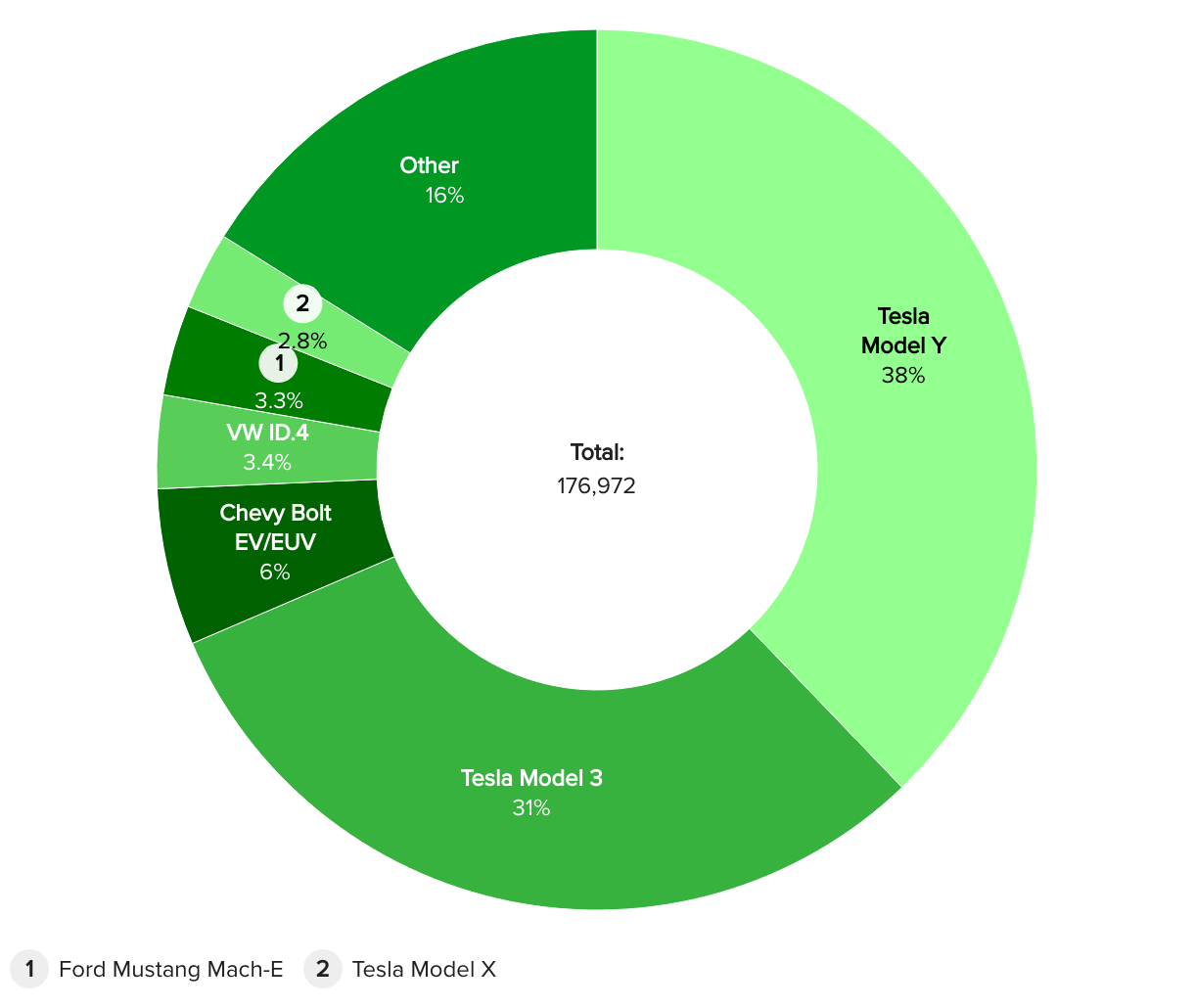

Emissions Reduction Tax Credit. This is 26 off the entire cost of the system including equipment labor and permitting. In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020.

You may notice something surprisingtheres no way to get an ev tax credit in 2022 for a tesla or gm ev. Georgia Power customers may be eligible to receive up to a 250 rebate for installing a Level 2 Charger in their home. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. For Teslas this isnt a problem as the minimum is well over this threshold. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

Georgia residents can easily claim federal solar credits so long as their solar panels were installed between 2006 and 2023. In Georgia the state legislature ended the 5000 credit for BEVs in 2016 but it is currently evaluating new incentives for vehicles and charging equipment. Create an additional 2500 credit for union-made EV.

Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a light-duty EV or PHEV. The effective date for this is after December 31 2021.

As of right now you can receive a 26 tax credit for your solar panels. After that it drops to 22 which is lower but still good. Income Tax Credit Policy Bulletins.

On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Income Tax Letter Rulings.

So based on the date of your purchase TurboTax is correct stating that the credit is not. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Mobile and Area Sources. March 14 2022 528 AM. Thats probably cold comfort to buyers who bought Teslas numbered 200001 to.

Georgia Tax Credit Prior to July 1 2015 Georgia allowed a generous tax credit for the purchase or lease of new BEVs. Georgia Tax Center Information Tax Credit Forms. Income Tax Credit Utilization Reports.

Statutorily Required Credit Report. As an individual you can get an income tax credit equal to 10 of equipment and installation costs if you install diesel particulate emissions reduction technology equipment at a truckstop depot or other facility. With the two added the EV credit you get is 7500.

Georgia Environmental Protection Division. Jctahoehomes Realtors Outdoor Decor Places Honda Acty 1999 2019 Price Overview Review Photos Pakistan Fairwheels Mini Van Honda Car Images. This credit was originally adopted by the state in 2001 three years before Tesla began development of its first model the Tesla Roadster and nine years before the introduction of the.

The tax credit is good for the year the equipment is installed. Heres how you would qualify for the maximum credit. EPD will review the completed certification form and supporting documents.

Tesla tax credit 2021 georgia.

Latest On Tesla Ev Tax Credit March 2022

Georgia Lands Rivian Ev Plant As Sun Belt Woos A Hot Electric Vehicle Market Npr

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

2022 U S Electric Vehicle Experience Evx Ownership Study J D Power

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car Tax Credits What S Available Energysage

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Latest On Tesla Ev Tax Credit March 2022

Current Ev Registrations In The Us How Does Your State Stack Up Electrek